1. Texas Instruments: will build a second 12-inch fab in Utah, USA

According to IT House citing foreign media MarketWatch reports, on Wednesday local time, Texas Instruments (TI) said that it will build a second 300mm semiconductor wafer manufacturing plant in Lehi, Utah, USA, which is TI’s $11 billion Utah facility. part of the investment. Once completed, the second plant will be merged with the existing plant and eventually operate as one plant.

TI has announced that the company’s board of directors has appointed Haviv Ilan as the next president and chief executive officer, effective April 1. Referring to the new plant in Utah, he said that with the expected growth of semiconductors in electronics, especially industrial and automotive, and the passage of the Chip Act, now is the perfect time to further invest in in-house manufacturing capabilities.

2. ADI’s operating profit tripled, industrial and automotive revenue hit new highs

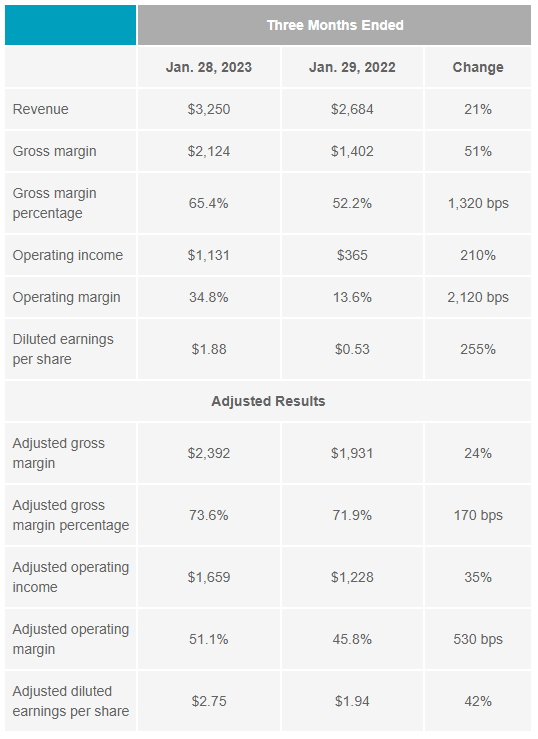

The analog original factory Analog Devices (ADI) announced its financial report for the first fiscal quarter of fiscal year 2023 as of January 28, 2023, with revenue of 3.25 billion US dollars, and all B2B markets achieved double-digit year-on-year growth, industrial and automotive Revenue hit a record high; gross profit margin was 65.4%, a year-on-year increase of 13.2 percentage points; operating profit was US$1.131 billion, a year-on-year increase of 210%.

ADI expects the revenue of the second fiscal quarter to be US$3.1-3.3 billion; the reported operating profit margin is expected to be approximately 34.7% (plus or minus 130 basis points), and the adjusted operating profit is approximately 51.0% (plus or minus 70 basis points); Reported earnings per share were $1.75 to $1.95, and adjusted earnings per share were $2.65 to $2.85.

3. Storage manufacturer Kioxia’s Q4 revenue fell 31% last year

According to the Science and Technology Innovation Board Daily, storage manufacturer Kioxia announced its 2022 Q4 financial report on the 14th. Due to the sluggish demand for PCs and smartphones and the inventory adjustment of data center customers, NAND Flash shipments have decreased, the supply and demand balance has deteriorated, prices have plummeted, and the company has reduced production. During the reporting period, consolidated revenue dropped by 31% year-on-year. % to 278.2 billion yen; a loss of 93.3 billion yen, the first loss in nearly seven quarters, and the largest loss in three and a half years.

4. Tongfu Microelectronics: It has mass-produced Chiplet chips for AMD, and orders accounted for more than 80%

According to the fast technology report, AMD’s CPU and GPU in the past two years have turned to the Chiplets small chip architecture. Each chip is composed of different modules, which can reduce production difficulty, improve yield, and control costs.

AMD’s small chip packaging mainly relies on domestic Tongfu Microelectronics. The company recently stated that through the advance layout of advanced packaging technologies such as multi-chip components, integrated fan-out packaging, and 2.5D/3D, it can provide customers with a variety of Chiplet packaging solutions, and has mass-produced Chiplet products for AMD . The company is AMD’s largest packaging and testing supplier, accounting for more than 80% of its total orders. In the future, as the integration of major customer resources is getting better, the synergistic effect will drive the entire industry chain to continue to benefit.