In the middle of 2023, due to the slow recovery of demand, the time for the industry chain to destock can be determined to be longer than previously expected. The demand for general-purpose materials depends on the boost of the traditional peak season, and there are still many high-priced models for automotive materials. Under the flat market tone, the market of GPU graphics cards has attracted attention, and AI applications have been placed with high expectations, and it is hoped that it will drive a large number of chip demand.

All kinds of IC materials: still see the polarization of general-purpose vehicles

In the past six months, the industry chain has basically been in the destocking stage. Under the dual effects of continuous improvement in the supply of original factories and demand that has yet to be boosted, the market for general-purpose IC materials continues to move closer to normalization. Including ST, TI, AD and other major original materials, the delivery time has generally fallen, and the supply is sufficient. Original manufacturers such as Infineon, ON Semiconductor, and NXP have a large share in the automotive market, and many materials still have sufficient demand.

The most mainstream general-purpose MCUs in the market, key MCU models such as TMS320, STM32F103, and STM32F429, all have different degrees of price decline within half a year. The price trend of high-performance MCUs such as STM32H743 and STM32H750 is also downward within half a year. Due to declining demand, improved supply from original manufacturers, and the maturity of domestic alternatives, mainstream MCUs will no longer be out of stock and increase in price, and the market will continue to operate normally.

In terms of analog chips, TI announced to follow up the price of domestic chips and launch more intense competition. However, behind TI’s aggressive grabbing of market share, in fact, the price of analog chips has been falling for a long time due to lower demand. For example, non-automotive chips of the TI brand TPS series have entered a price decline cycle since a year ago. The inevitability of TI chip price reduction stems from its large-scale expansion of production in recent years, especially its dedication to 12-inch production capacity, which will greatly increase the material supply capacity, which will lead to a “price war” for general analog materials. Not only TI, but also ADI, the second largest analog manufacturer, has also greatly expanded its production in the United States, Ireland and other places. With the release of new production capacity one after another, the usual analog materials should no longer be out of stock.

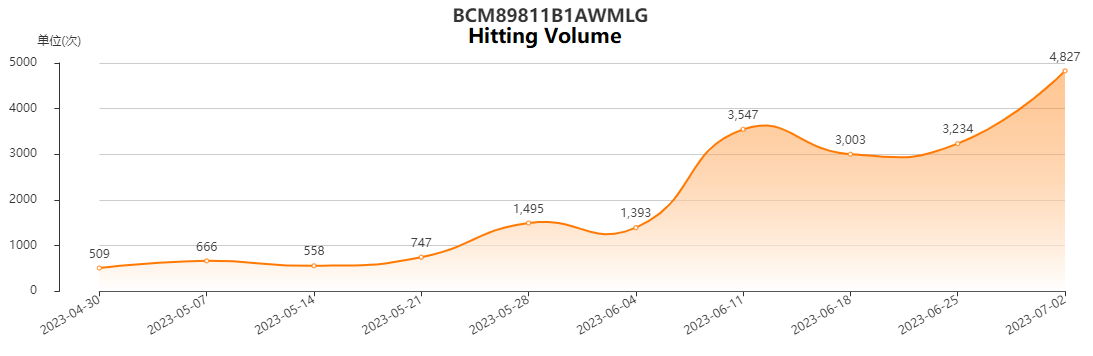

At this stage, materials with limited supply and high prices are still concentrated in the automotive field. Models such as MPC5554MVR132, O3853QDCARQ1, VNH5019ATR-E, etc. are in high demand due to the imminent end of production or irreplaceability, and are now fluctuating in four-digit high prices. Recently, Broadcom’s automotive network chip BCM89811B1AWMLG has become popular, and its price has also risen, which has the potential to become a new Internet celebrity.

Memory: In the process of bottoming out, the second half of the year is expected to enter a new cycle

In the early stage, storage manufacturers voluntarily saved their revenue. Original manufacturers including Micron and Samsung announced that they would no longer accept lower quotations and started to cut production at the same time. However, due to the fact that demand has not improved significantly, this move by the original manufacturers can only guarantee The price will not continue to drop, and it will not actually drive the price of memory to rise.

As the traditional peak season is approaching, although the current average price of memory is close to the production cost, there are still doubts about the demand, and a decline in the market is almost certain. At this critical juncture of cycle transition, the original factory has once again raised the idea of raising prices. According to industry sources, the three major DRAM manufacturers intend to increase the contract price by 7%-8%, and Samsung is also planning to raise the price of NAND flash memory wafers before. These measures reflect that the original storage manufacturers are generally eager to improve revenue, especially Micron, which has a weaker share and profit than the two Korean manufacturers, and will further cut production by 30%. As the supply of original manufacturers further narrows, the time for memory price reversals will also be approaching.

Judging from the market cycle in recent years, the growth rate of memory sales will peak in the third quarter of 2021, and the growth rate will turn negative in 2022 and start a cycle of price cuts and destocking. According to the World Semiconductor Trade Statistics Association (WSTS) data, the revenue growth rate of the storage industry usually takes 1-2 years from peaking to bottoming out. It can be inferred from this that the current downward cycle is about to bottom out, and it is expected that the time point will fall this year. third or fourth quarter. As for whether the memory will return to price increases in the future, the demand remains to be seen.

It is also worth mentioning that the HBM memory that fits with AI is ushering in growth against the trend. The report pointed out that after the beginning of 2023, the HBM orders of Samsung and SK Hynix increased rapidly, and the price of products with HBM3 specifications increased by 5 times. The reason is that HBM’s high-bit-width feature can enable AI servers to achieve a high level of data throughput, and with the continuous development of the AI industry, the demand for chips including HBM storage and GPU will continue to rise, and this will to a certain extent To save the overall weak demand situation.

Wafer foundry and HPC chips: AI and mobile phone fields are different

Due to the sluggish demand for consumer electronics, TSMC’s capacity utilization rate dropped to 75% in the first quarter of this year. Among the various manufacturing processes, the 6/7nm and 4/5nm declines were the most obvious. The reason is that MediaTek, AMD and other processor customers cut orders. In the second quarter, the peak turned around, AI demand erupted, and Nvidia’s GPU increased production capacity, which greatly boosted the utilization rate of TSMC’s advanced process capacity. Among them, the 5nm production capacity increased from 50% to 70-80%, and the 7nm production capacity increased from 30-40%. to about 50%.

The increasing demand for AI has made Nvidia’s high-end GPUs extremely sought-after. Especially after some products were restricted from being exported to the domestic market, the price increase became even more serious. Based on market information, the A800, which was originally priced at about 74,000 yuan, has now risen to more than 85,000 yuan, and the high-end version has risen to about 100,000 yuan. The price of an A800 single card has increased to 100,000 yuan, and the price of an 8-card A800 module has risen from 900,000 yuan at the end of April to more than 1 million yuan, and the delivery time has also been greatly extended.

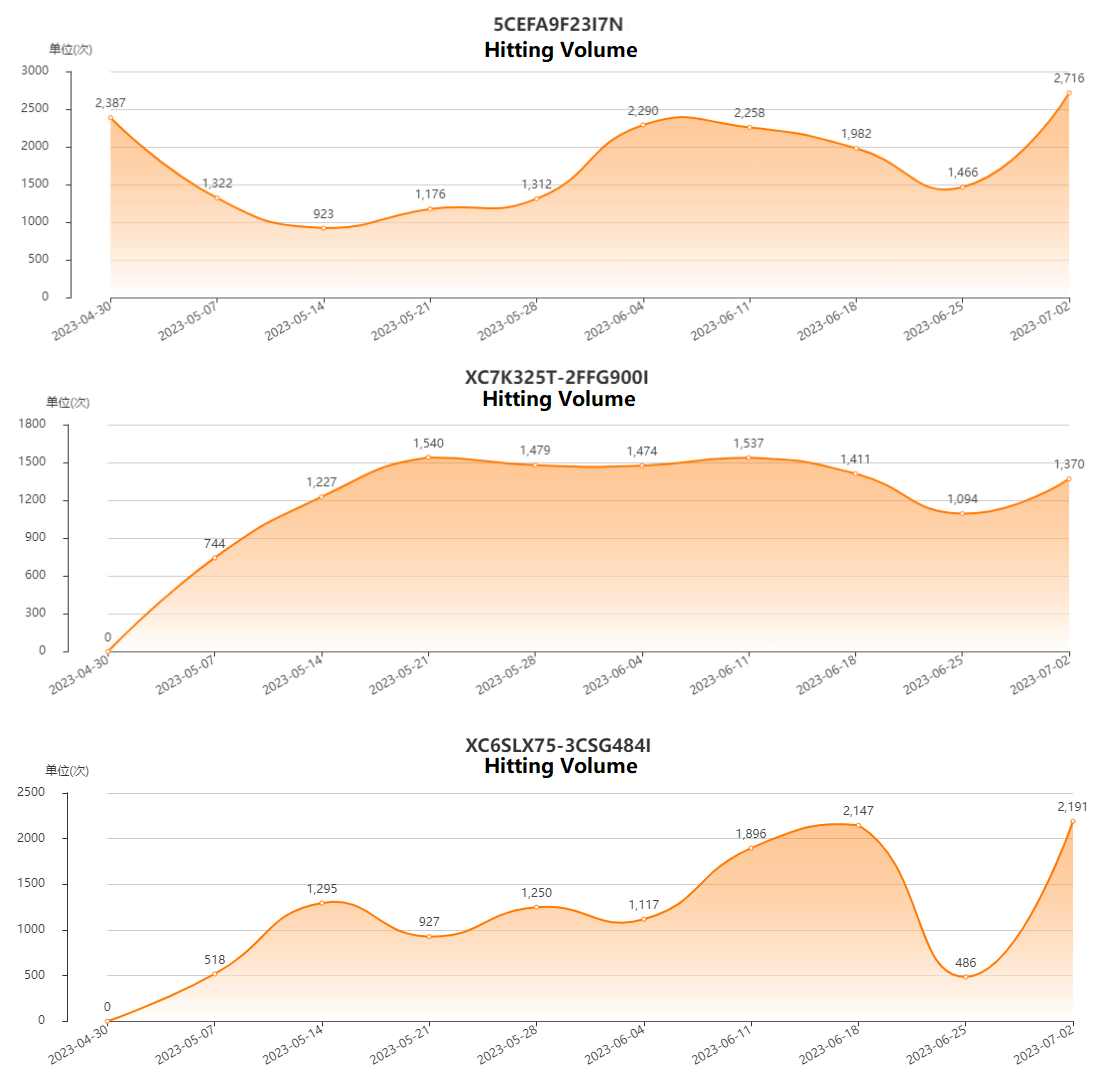

In addition to GPUs, various types of HPC (high-speed computing) chips such as CPUs and FPGAs are also widely used in the field of AI servers. Referring to the hot search list of Chuangxin Index in recent weeks, the attention of many FPGAs has increased, including 5CEFA9F23I7N in Altera Cyclone V series, XC7K325T-2FFG900I in Xilinx Kintex-7 series, XC6SLX75 in Xilinx Spartan-6 series -3CSG484I etc.

In terms of advanced manufacturing processes, another chip that occupies an important proportion is the SoC used in mobile phones. The sluggish sales of mobile phones during the “618” promotion prompted Qualcomm and MediaTek to lower their wafer production and product prices in foundries. In the second half of the year, the conservative tone of the mobile phone market is also basically confirmed. Relevant industry estimates indicate that MediaTek and Qualcomm will not be able to return to normal wafer production levels until 2024.

In general, the surge in demand in the AI market will bring additional momentum to foundries, but the sluggish demand for mobile phone SoCs means that the destocking cycle of the industry chain is still continuing. Research firm IDC predicts that the global wafer foundry market will decline slightly by 6.5% this year, and the official recovery of the wafer foundry industry may not be realized until the start of a new cycle next year.

Conclusion: Looking forward to the “busy” peak season in the second half of the year

Compared with the first half of the year, the second half of the year belongs to the traditional peak season after all. There are many hot spots such as Apple’s new products, the school season, and Double Eleven. The cumulative demand created by these hot spots will obviously be higher than that of the first half of the year. In the second half of the year, the inventory situation of the industrial chain will definitely be better than that in the first half of the year, and it will be more conducive to the supply of goods in the industrial chain. Therefore, it can be expected that the performance of major IC companies in the second half of the year will be better than that in the first half of the year.