1. The latest mergers and acquisitions in the distribution industry! Wenye will acquire Future Electronics for US$3.8 billion

According to foreign media SemiMedia, WT Microelectronics, an authorized distributor of components, announced yesterday that it has disclosed major matters and is scheduled to suspend trading on the 14th. According to insiders in the component supply chain, Wenye Technology is about to conduct a major merger and acquisition, targeting Future Electronics, a world-renowned electronic component distributor headquartered in Canada. Wenye occupies a large share of the Asian market, and the acquisition of Future Electronics will help expand its brand line and enhance its influence in the global market.

Public information shows that Wenye ranks fourth in the global electronic component distributor rankings in 2022. The top three are Arrow Electronics, Dalianda Group and Avnet.

Today (14th), Wenye issued an announcement that it has signed a formal agreement to acquire 100% of Future Electronics’ shares for US$3.8 billion in all cash. The combination of two highly complementary companies is expected to create long-term and sustainable growth value for all stakeholders, including customers, suppliers, employees and shareholders.

2. Samsung increases prices of mobile phone memory and NAND flash memory by 20%

According to Kuai Technology news, for many storage manufacturers, price increases are inevitable after reducing production and controlling production capacity, and the leader Samsung is already promoting it in an all-round way. The latest news shows that Samsung Electronics has increased its DRAM and NAND flash memory prices by 10%-20% for major smartphone manufacturers, including Xiaomi, Google, etc.

According to supply chain sources, Samsung is likely to set an example, and more storage manufacturers will do such things in the future. Due to Samsung’s advantage in mobile phone storage, this will inevitably lead to a number of mobile phone manufacturers to consider the price trend of higher-capacity storage in the future.

3. Academy of Information and Communications Technology: Domestic mobile phone shipments fell 6.8% year-on-year in July

According to IT House, data from the Academy of Information and Communications Technology showed that in July 2023, mobile phone shipments in the domestic market were 18.552 million units, a year-on-year decrease of 6.8%, of which 15.058 million 5G mobile phones were increased by 2.6% year-on-year, accounting for 81.2% of mobile phone shipments in the same period. %.

From January to July 2023, the total mobile phone shipments in the domestic market totaled 148 million units, a year-on-year decrease of 5.1%, of which 5G mobile phone shipments were 117 million units, a year-on-year decrease of 5.3%, accounting for 79.2% of mobile phone shipments during the same period.

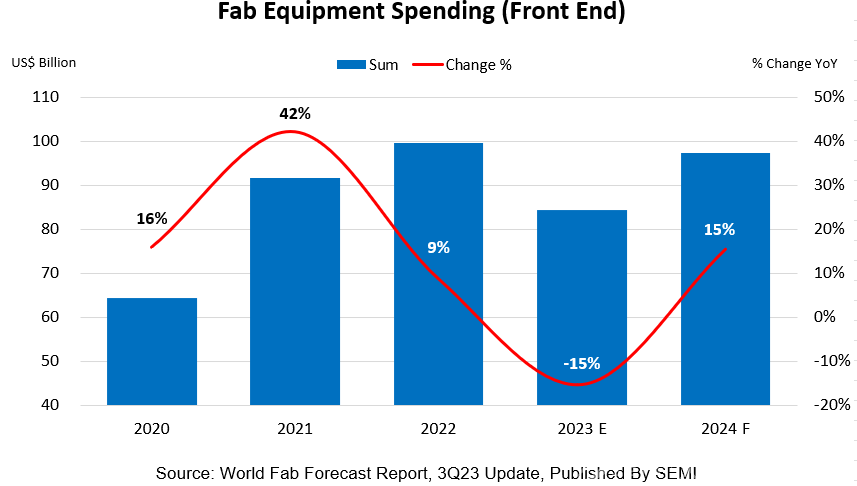

4.SEMI: Global fab equipment spending is expected to recover in 2024

The International Semiconductor Industry Association (SEMI) recently released a report, predicting that global fab equipment spending will fall by 15% to US$84 billion in 2023, and will rebound by 15% to US$97 billion in 2024. The decline in 2023 will stem from weaker chip demand and rising consumer and mobile device inventories.

The recovery in fab equipment spending next year will be driven in part by the end of semiconductor inventory adjustments in 2023 and stronger demand for semiconductors in HPC and memory. Wafer foundry (Foundry) expenditures are expected to increase by 5% next year to US$51.5 billion; memory expenditures will increase by 65% to US$27 billion next year; MPU expenditures will increase by 16% to US$9 billion.

5. Tesla plans to double the amount of parts purchased from India this year

TechWeb quoted foreign media reports that on Wednesday, Indian Commerce Minister Piyush Goyal said that Tesla plans to purchase parts worth US$1.7 billion to US$1.9 billion from India this year, almost double the amount purchased last year. These parts will meet the rapidly growing domestic demand for electric vehicles in India and may also make India a key player in the global electric vehicle parts supply chain.

Goyal’s comments come as the Indian government and Tesla are in talks to build an electric vehicle factory. The proposed factory will produce a low-cost electric car with a starting price of about 2 million rupees (equivalent to $24,500), which is about 25% cheaper than Tesla’s current entry-level model.