Starting from the second half of last year, the shock period in the semiconductor industry was like a “long season” that lasted for several quarters. With Huawei’s “Return of the King” and the release of Apple’s new phones in September, the traditional electronics peak season has been ignited again, and the information revealed by industry data and sales data also indicates that the industry cycle is bottoming out. It is worth noting that local demand will play the leading role in this cycle. Therefore, it is crucial to seize the opportunity and take the lead in deploying now.

The cycle is finding its bottom

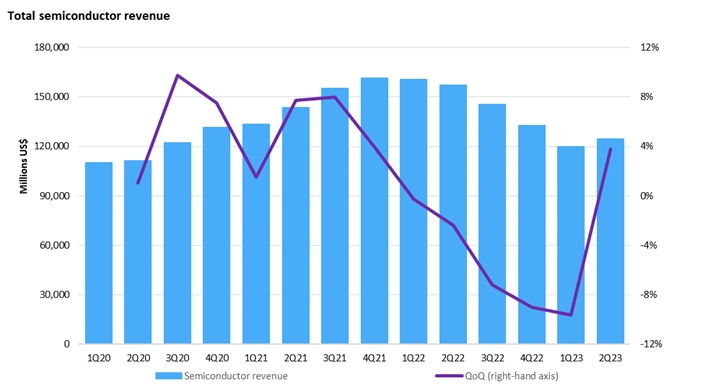

A recent report from market research organization Omdia showed that after five consecutive quarters of revenue decline, the revenue of the semiconductor industry reversed the trend in the second quarter of 2023, growing 3.8% quarter-on-quarter to US$124.3 billion.

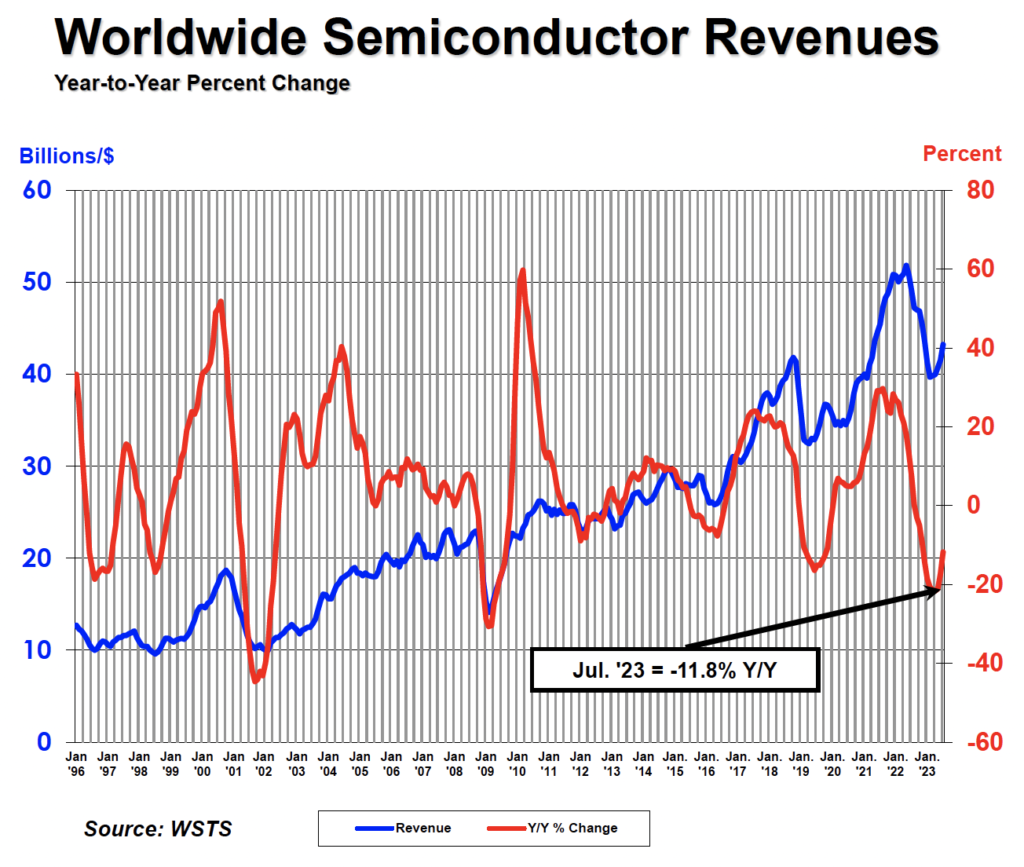

After five quarters of decline, the current trend reversal is undoubtedly a welcome sign. Judging from the statistics of another important organization, the Semiconductor Industry Association (SIA), we can also find signs that the cycle will bottom out and turn upward.

SIA statistics show that global semiconductor industry sales in July this year totaled US$43.2 billion, still a year-on-year decrease of 11.8%, but a month-on-month growth of 2.3%. Judging from the general trend, July has been the fourth consecutive month of revenue growth for the global semiconductor industry, and the year-on-year revenue decline has also continued to shrink from the level of more than 20% in April this year. It can also be seen that the trend of the semiconductor industry will be more optimistic for the rest of this year, and it is expected to gradually get rid of the impact of this shock cycle.

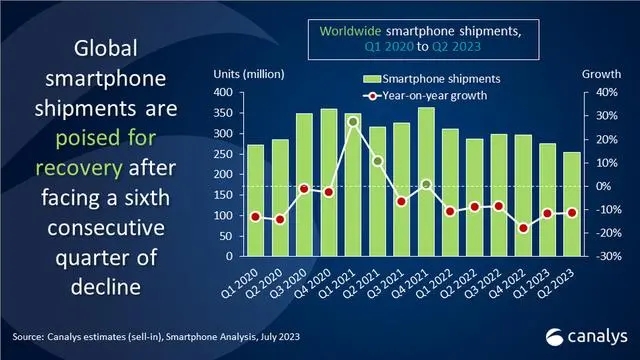

Judging from the changes in shipments of consumer electronics products, it can also confirm the bottoming signal of the cycle. TrendForce statistics show that global mobile phone production in the second quarter of this year was 270 million units, which was still 13.3% lower than the same period last year, but it was an 8% increase from the first quarter’s production of 250 million units. Research firm Canalys pointed out that the global smartphone market fell 10% year-on-year in the second quarter, a decline narrower than the first quarter, and is sending out early signs of recovery.

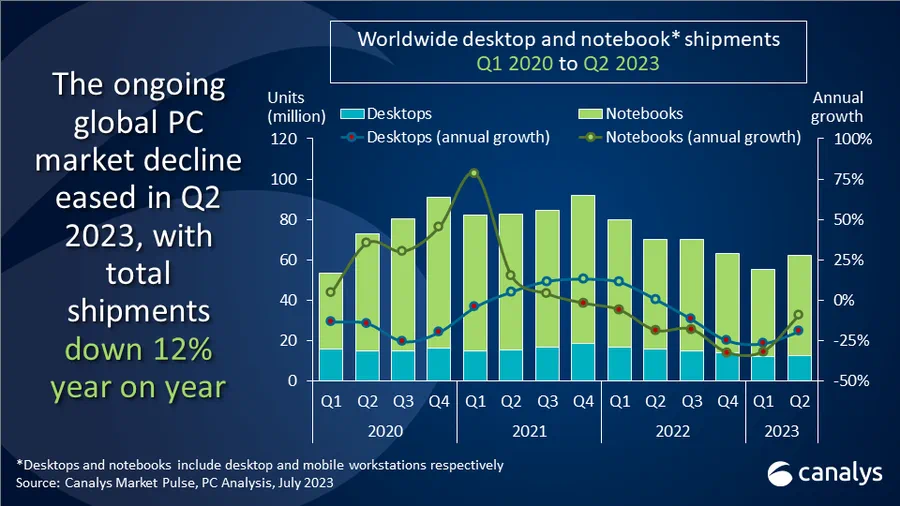

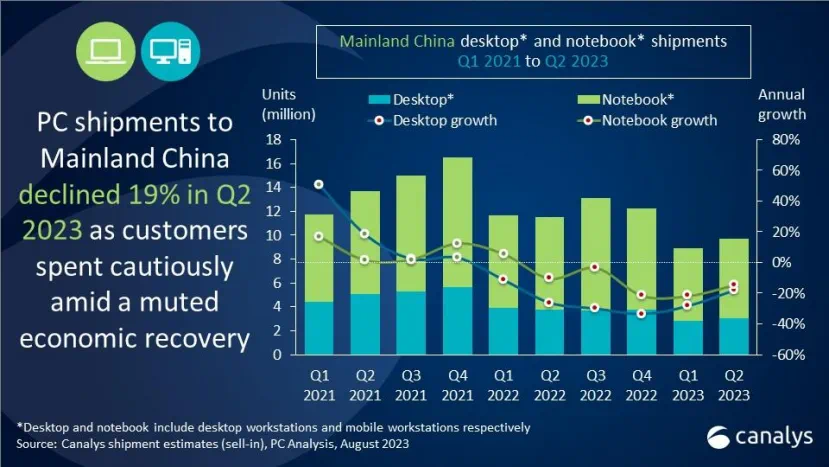

In terms of PC, according to statistics from Canayls, global shipments in the second quarter reached 62.1 million units, a year-on-year decrease of 11.5%, but a 12.5% month-on-month increase. In the domestic market, statistics from the same agency show that shipments in the second quarter reached 9.6 million units, still a 19% year-on-year decrease, but a 7.9% increase from the first quarter’s 8.9 million units. Taking into account the month-on-month growth trends of the global and domestic markets, it can be seen that the recovery signal is equally clear.

The combination of the month-on-month changes in the two major consumer goods, mobile phones and PCs, the bottoming out of the semiconductor industry cycle signal, and the upcoming electronics peak season, can be inferred that the market will usher in a round of recovery. But unlike in the past, affected by various factors, this round of recovery will be played by the local market. This is deeply reflected in the recent integration of many local companies in Huawei Mate 60 Pro.

Huawei’s industrial chain is increasingly taking shape, boosting local demand growth

Recently, Huawei Mate 60 Pro was suddenly released without any warm-up, which greatly stimulated the domestic electronics industry chain. In addition to the core SoC coming from major domestic wafer foundries, supply chain sources claim that Mate 60 Pro is the mobile phone with the highest localization rate of components so far, exceeding 90%.

According to relevant reports, Huawei is currently launching a plan to return to the mobile phone market. A number of technological breakthroughs in the past three years have laid the foundation for this return. Huawei has raised its mobile phone shipment plan this year from 30 million units at the beginning of the year to 38 million units (of which 20 million units have been completed), and the 18 million units have not yet been completed. According to the prediction of Ming-Chi Kuo, a well-known mobile phone industry chain analyst, Mate 60 Pro may account for 5.5-6 million units.

Mate 60 Pro has been popular in the market since its launch. Compared with the “mediocre” Apple iPhone 15 series this year, it undoubtedly gives Huawei an opportunity to catch up. What Mate 60 Pro reflects is not only the return of Huawei, but also that it is a mobile phone with the highest degree of localization of components, and behind it is an increasingly mature industrial chain. From now on, it has become a reality to build a Huawei industrial chain with a “nationally produced” lineup to compete with the “fruit chain”. This huge industrial chain will surely attract more and more companies, drive more and more demand for domestic chips, and promote a virtuous cycle of the local electronics industry chain.

Since the “core shortage wave”, the process of replacing domestic chips in the local electronics industry chain has been accelerating, and Huawei’s accumulated experience has verified that domestic chip manufacturing and supply chain support have reached a certain level. As the internal and external environment becomes increasingly complex, domestic demand is on the rise and has become a key factor supporting the local electronics industry.

When this cycle hits the bottom, it is particularly critical for the local industrial chain to clearly identify the next recovery trend. With this understanding in mind, we will surely find that challenges contain a lot of opportunities. For now, the electronics peak season has just begun, and it will take time for demand to recover, but no matter what, if you stick to it, spring will come!