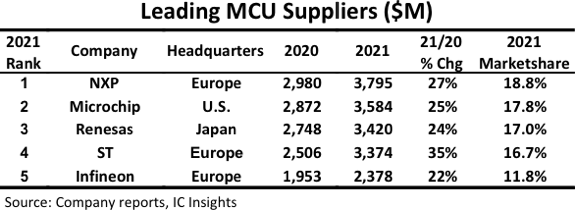

Some time ago, IC Insights, a semiconductor research organization, updated the ranking of global MCU manufacturers in 2021. It can be seen from this that the top five factories are ranked NXP, Microchip, Renesas, ST, and Infineon. Their revenue growth in 2021 will all be more than 20%, and they will occupy a total of up to 82% of the market share.

This data shows that the MCU market has developed a high degree of concentration, and the leading manufacturers still maintain strong growth potential.

In contrast, the top five suppliers after the top five (TI, Nuvoton, Roma, Samsung, Toshiba) MCU sales last year was only 2.3 billion US dollars, accounting for 11.4% of the total market. The MCU manufacturers outside the top ten will have a total market share of only 6.5% in 2021, and their influence will be even smaller.

IC Insights also pointed out in the report that the combined share of the top five manufacturers in 2016 was 72.2%, and this figure has increased to 82% in just five years, which shows that the concentration of the MCU market is getting stronger and stronger. The reason is inseparable from the serial mergers and acquisitions of the five major factories in recent years.

Serial mergers and acquisitions have created a high degree of concentration in the MCU market

The reason why NXP became the largest MCU manufacturer is that it acquired Freescale for $11.8 billion in 2015. In recent years, NXP itself has repeatedly become the target of mergers and acquisitions. In 2016, Qualcomm tried to acquire NXP, but failed due to monopoly issues. Recently, it is rumored in the industry that Samsung will also acquire NXP, and it is expected that the monopoly dispute will still be the primary obstacle.

Second-ranked Microchip acquired Atmel for $3.56 billion in 2016, making it the third-largest maker of MCUs. In 2018, Microchip acquired Microsemi for $8.35 billion, expanding its scale again.

Renesas, ranked fourth and third, acquired Intersil for $3.219 billion in 2018, IDT for $6.7 billion in 2018, and Dialog Semiconductor for 4.9 billion euros in 2021. These acquisitions are mainly to enhance the diversified competitiveness of Renesas, and they are not as meaningful as the larger mergers and acquisitions carried out by NXP, Microchip and Infineon for expanding market share.

Infineon, ranked fifth, acquired Cypress for 9 billion euros in 2019, enhancing its competitiveness in various fields such as consumption, automotive, and industrial control.

The above mergers and acquisitions have played an important role in expanding the share of MCU leading manufacturers. Looking forward to the future, high-quality M&A targets have already been owned, and it is difficult to rely on M&A to substantially expand the scale. With the weakening of consumer electronics and the growing popularity of automotive electronics, it is expected that automotive products with high technology content and high gross profit margin will become the primary driving force for the continued expansion of leading MCU manufacturers.

Among the top five MCU manufacturers, all four except Microchip focus on automotive materials. With the development of the ARM architecture in recent years and the advancement of transistor scaling technology, more and more head MCU manufacturers are producing products with higher integration and higher performance through wafer foundry, serving the needs of automobiles and industrial control. higher-end industries.

Layout for vehicles, leading manufacturers strengthen cooperation with foundries

IC Trading Network learned that generally IDM’s own production line can reach 40nm node at most, and more advanced 28/22nm and even 16nm products must rely on foundry production. With the development of automotive intelligence and new energy vehicles, the industry’s demand for advanced automotive-grade MCUs will also promote the cooperation between the original factory and the foundry.

The original factory is responsible for research and development of advanced products, and the foundry is responsible for mass production. A clear division of labor will further improve the efficiency of the industry chain, and this emerging Fab-Lite model will also help leading MCU manufacturers to obtain more profits, and Maintain an active position in industrial competition.

In the trend of co-promoting high-performance products with foundries, NXP is the most “radical”. In early June, the company announced that it will use TSMC’s 5nm process to create a new generation of S32 series automotive processors. In addition, NXP has just released the 16nm S32Z and S32E series MCUs, which can enhance the integration of automotive circuit design. Only one advanced process MCU can replace the functions that could only be achieved by multiple chips in the past.

Among NXP’s current automotive MCUs, there are 32-bit S32K series based on ARM M7 architecture, 32-bit KEA series based on ARM M0 architecture, and 32-bit S32R series radar MCUs.

Renesas is rooted in Japan, a major automotive country, and also has an outstanding automotive MCU product line, including 16-bit RL78 series automotive MCUs, 32-bit RH850 series automotive MCUs, and R-Car automotive SoC series. In recent years, Renesas has also formed a solid cooperative relationship with TSMC, especially after the Naka factory was shut down due to a fire last year, Renesas has increased the amount of film production in TSMC.

In terms of ST, automotive MCUs are mainly 32-bit SPC5 series, covering various applications such as body gateways, high-performance security functions, and 16-bit ST10 series automotive MCUs. ST also released a new Stellar E series MCU for electric vehicles this year, which is planned to be mass-produced in 2023.

Infineon’s main products in the automotive field are 32-bit TC3 series MCUs with AURIX architecture, which can play a role in automotive powertrain, body control, audio-visual instruments and even automatic driving. This year, Infineon’s newly released TC4 series MCU has improved scalability in all aspects. This new product is expected to start mass production in 2024.