1. NXP’s automotive business revenue is still growing, and accounts for more than half

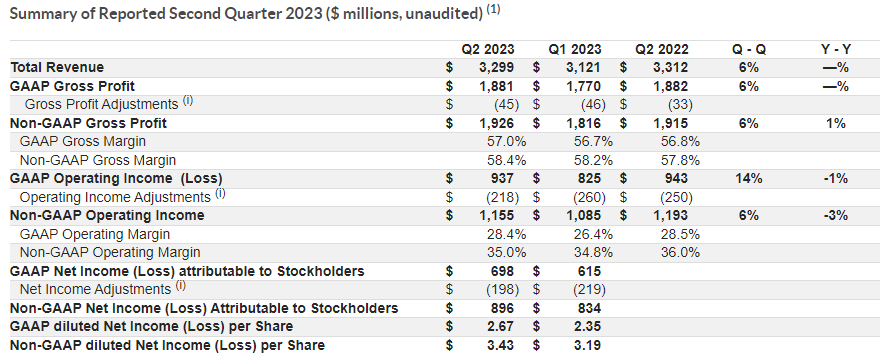

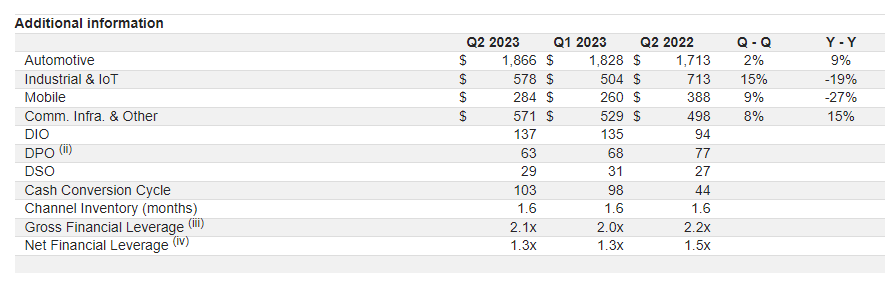

On July 24, NXP announced its second-quarter financial report, with revenue of US$3.3 billion, a slight decrease of 0.4% year-on-year, and an increase of 6% quarter-on-quarter; operating profit of US$937 million, a slight decrease of 1% year-on-year, and an increase of 14% quarter-on-quarter. Channel inventory was 1.6 months, which was flat year-on-year.

In terms of business, the revenue of the automotive business was US$1.866 billion, a year-on-year increase of 9%. Industrial and Internet of Things business revenue was US$578 million, a year-on-year decrease of -19%. Mobile business revenue was $284 million, down 27% year-over-year. Communication infrastructure and other businesses amounted to US$571 million, a year-on-year increase of 15%.

NXP President and CEO Kurt Sievers said revenue trends in all key end markets were better than expected. First-half results and third-quarter guidance reinforce confidence that NXP is successfully navigating the cyclical downturn in our consumer business. For the third quarter, NXP expects revenue of $3.3 to $3.5 billion and operating profit of $921 to $1.053 billion.

2. Mylink Technology terminated the acquisition of NAND flash memory master control factory Huirong

On July 26, American analog and radio frequency chip company Maiwei Technology announced the termination of the merger agreement with NAND flash memory master control company Huirong Technology.

Maiwei Technology stated that the reasons for terminating the acquisition of Huirong include that certain delivery conditions stipulated in the merger agreement have not been met and cannot be met; Huirong has suffered continuous significant adverse effects; Representations, warranties, covenants and agreements that have the right to terminate; in any event, the first extended outside date has passed and due to certain conditions in clause 6 of the merger agreement as of May 5, 2023 have not been satisfied or Discard, so it is not automatically extended.

3. Canayls: Global smartphones fell by 10% in the second quarter, and post-recovery is imminent

According to the fast technology report, the latest report from market research firm Canalys shows that global smartphone shipments fell by 10% year-on-year, narrowing the decline from the first quarter, showing signs of improvement. Among the top five smartphone manufacturers, Xiaomi was the first to win the favor of the recovery of demand in the smartphone market. In the second quarter, its market share increased by 2 percentage points from the previous quarter to 13%. The market share increased significantly from the previous quarter, leading the industry.

Canalys pointed out that the smartphone market is sending early signs of recovery after six consecutive quarters of decline since 2022, and that healthier inventory levels among mobile phone manufacturers can effectively prepare for a potential market recovery.

4. Storage manufacturers are optimistic about the bottom of the industry, and the fourth quarter is expected to balance supply and demand

According to news from the Science and Technology Board Daily on the 27th, storage manufacturers such as Nanya Branch and ADATA said that the overall industry has bottomed out, and the industry’s supply and demand are expected to return to stability in the fourth quarter.

Nanya Branch pointed out that in the second quarter, DRAM suppliers actively destocked, and all factories were adjusting production capacity and capital expenditure. Therefore, although the price of DRAM products rose and fell in the third quarter, the overall price decline was restrained, and sales volume increased slightly. The bottom has been established in the second quarter, and there is a chance to gradually improve in the second half of the year. It is expected that supply and demand will return to stability in the fourth quarter.

ADATA said that the spot price of DRAM has stabilized and stabilized in the second quarter, and it is optimistic that the contract price of DRAM will bottom out in the second half of the year. The attitude of upstream suppliers towards DRAM prices has turned positive, and the room for bargaining has been tightened. With the benefits of production cuts appearing in the third quarter, and the DRAM inventory level of end customers generally returning to health, it is expected that the decline in DRAM contract prices will be significantly reduced this quarter, and spot prices are expected to take the lead in rising.