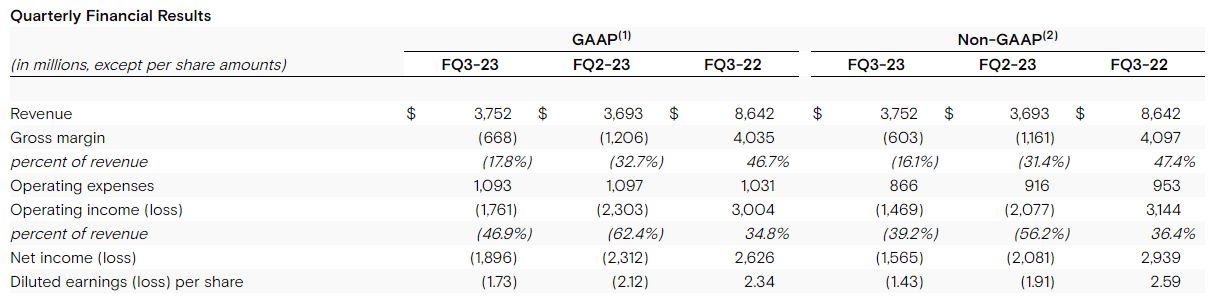

1. Micron’s net loss in the third fiscal quarter was US$1.9 billion, and it will vigorously reduce production by 30%

A few days ago, Micron, the original memory manufacturer, announced its financial report for the third quarter of the 2023 fiscal year, with revenue of 3.75 billion US dollars, a year-on-year decrease of 57%, and a slight increase of 2% from the previous quarter; Losses decreased by 18%; operating cash flow fell sharply to US$24 million, compared with US$343 million in the previous quarter and US$3.84 billion in the same period last year.

Micron will further reduce the production of DRAM and NAND flash wafers by 30%, which is expected to last until 2024. For the fourth quarter, Micron expects revenue to be $3.9 billion, plus or minus 200 million U.S. dollars; gross profit margin is 12.5%, plus or minus 2.5 percentage points. Micron believes that the memory industry has passed the trough period of revenue, and as the balance between supply and demand is gradually restored, profit margins will increase.

2. The demand situation in the notebook supply chain has improved

According to Taiwan’s Electronic Times quoted by the Science and Technology Board Daily, as the destocking comes to an end, notebook ODMs have given positive expectations for the market outlook in the third quarter of 2023, showing that demand from clients has shown signs of recovery.

Notebook supply chain operators revealed that the first half of 2023 will indeed be difficult due to the impact of destocking, but the situation has gradually improved since late May. As for whether the notebook market can return to the previous level in the second half of the year, several supply chain players, including connectors and power supplies, believe that although the worst of the notebook industry has passed and there are signs of returning orders, in the end it is still It depends on when the market as a whole can return to the pre-epidemic normal.

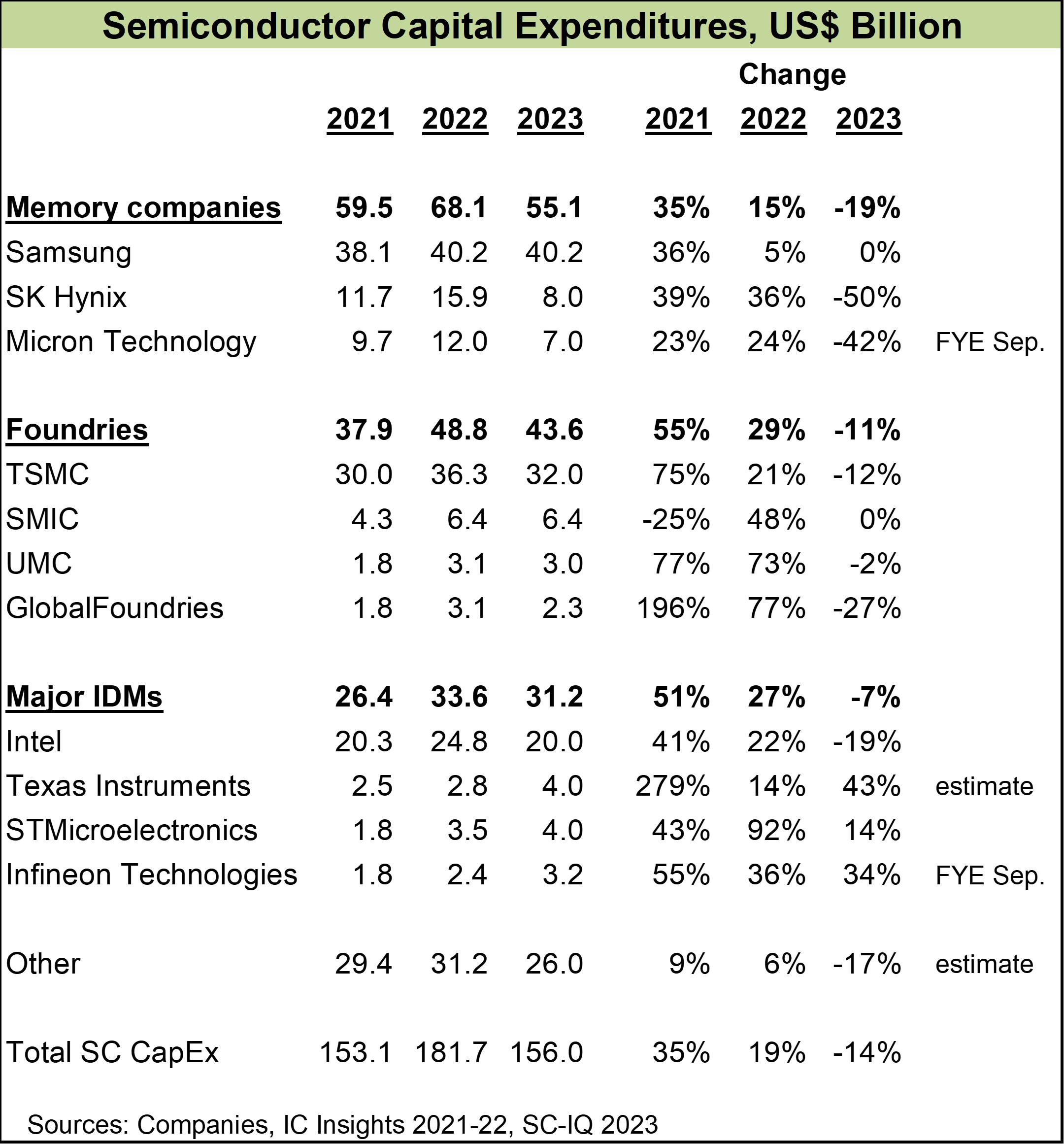

3. Institutions: 2023 global semiconductor capital expenditure will be reduced by 14%

According to the latest report from Semiconductor Intelligence, a semiconductor analysis agency, capital expenditures will drop by 14% in 2023. The largest reduction is in storage companies, with a drop of 19%, of which SK Hynix’s capital expenditure will drop by 50%, and Micron’s capital expenditure will drop by 42%. Among the major IDMs, Intel plans to cut 19%, and Texas Instruments, STMicroelectronics and Infineon will increase capital spending in 2023, reversing this trend.

Companies that slash capital expenditures are typically associated with the PC and smartphone markets, while those that increase capital expenditures are associated with the automotive and industrial markets. In 2023, Samsung, TSMC and Intel will account for about 60% of total semiconductor capital spending. The factors behind capital expenditure decisions are complex. Since fabs take two to three years to build, companies must forecast demand for years to come.

4. Longsys acquires 70% equity of Purchasing Suzhou

On June 27, Longsys, a domestic storage company, announced that through its wholly-owned subsidiary, it has acquired 70% of Powercheng Technology (Suzhou) Co., Ltd. (Powercheng Suzhou), a wholly-owned subsidiary of Powercheng Technology Co., Ltd. (Powercheng Technology) equity.

Founded in 1997, Powertech is the world’s largest third-party memory chip packaging and testing company. Powercheng Suzhou, formerly known as Advanced Micro Semiconductor and Spansion Semiconductor, became a wholly-owned subsidiary of Powercheng Technology in 2009. Its main business includes chip packaging, testing and placement. The main products are flash memory chips, memory chips and logic chips.

After the completion of this transaction, Longsys will form a strategic partnership with Powertech Technology based on Powertech Suzhou to jointly increase investment in storage packaging and testing technology, and further enhance Longsys’ innovation capability, product quality and competitiveness in the storage industry .